Guide to UK Clean Air and Low Emissions Zones

A Guide to UK Clean Air and Low Emissions Zones

Introduction

Under the Transport Act 2000 (the Act), provision was made for local authorities to introduce Clean Air Zones (CAZ) to improve air quality. If a vehicle exceeds defined emission standards, the owner is liable to pay a charge for entry.

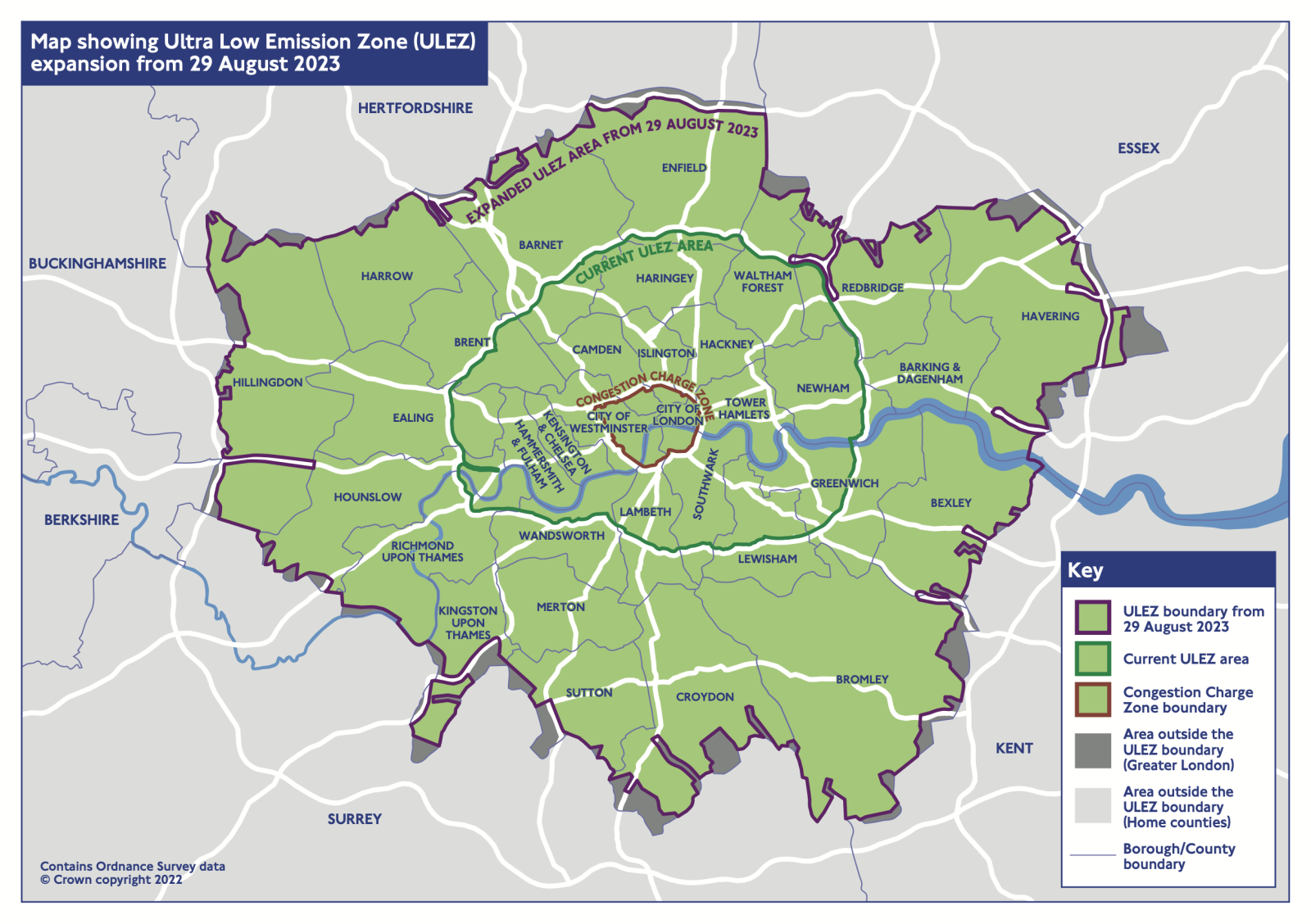

The position in London is somewhat more complex where there are LEZ, ULEZ and Congestion zones all made under legislation unique to London.

Whilst there is some similarity in the way local authorities have implemented CAZ or LEZ, delegation of powers to local areas has resulted in differences. These are demonstrated, for example in the treatment of commercial vehicles less than 40 years old and retired into preservation and also historic vehicles visiting from overseas.

Historic Vehicles

The good news is that all the Orders made through secondary legislation under the Act or under the separate legal provisions for London which authorise charging, contain provisions EXEMPTING from charge vehicles in the historic vehicle tax class.

A vehicle qualifying for that tax class is one which at any time during the period of 12 months beginning with 1 April in any year was constructed more than 40 years before 1 January in that year. In addition, some authorities have granted more limited local exemptions or discounts for what are normally termed “non-commercial vintage buses”. These are usually defined as less than 40 years old and more than 20 years old.

London

As mentioned in the introduction, the situation and rules in London are complex and quite different from the zones in other UK cities. Currently London is subject to the following charging regimes; a Congestion Charge Zone, an ULEZ and a LEZ.

Although the ULEZ and LEZ operate in the same area, they are different schemes. The Table below shows the different charges for London and their applicability to.

There are a number of different charges one needs to consider before taking a historic vehicle (by which we mean the definition of a vehicle over 40 years of age) into London.

The table below summarises the position.

|

|

Congestion Charge |

London ULEZ |

Greater London LEZ |

|

Area covered |

Central Area; approx. Marylebone, Westminster, City, Southwark |

Approx. Inside M25 [Note: From 29 August 2023 the zone was expanded to cover all areas roughly inside the M25] |

Approx. Inside M25 |

|

Times operational |

07:00 to 22:00 daily except Christmas Day |

24/7 except Christmas Day |

24/7 |

|

Dates operational |

Now |

Now, with stricter requirements now in force. |

Now, with stricter requirements now in force. |

|

Vehicles subject to charge |

Cars and trucks |

All vehicles not meeting defined emissions standards unless specifically exempted. Petrol cars/vans must be Euro 4 or better (generally post-2005/6). Diesel cars/vans must be Euro 6 or better (generally post-2015). |

Diesel vans/pickups, diesel minibuses, and all lorries and buses regardless of fuel type |

|

Vehicles exempt |

Motorbikes and buses (the latter need to register) |

Vehicles in historic VED class or vehicles manufactured before 1973 in any VED class |

Motorbikes and cars, petrol/gas vans/pickups/minibuses, vehicles in the historic VED class and vehicles manufactured before 1973 in any VED class |

|

Charges Per Day |

|||

|

Car |

£15 |

£12.50 |

0 |

|

Motorbike |

£0 (see note 1) |

£12.50 |

0 |

|

Van |

£15 |

£12.50 |

£100 |

|

Minibus |

£0 (see note 1) |

£12.50 |

£100 |

|

Lorry |

£15 |

£300 (see note 6) |

|

|

Bus |

£0 (see note 1) |

£300 (see note 6) |

|

As is confirmed on the TfL website and by a Federation check of the 2018 Order varying the original zone, there are no changes to the current exemptions for historic vehicles.

However those accepting the invitation on the TfL website to check whether their vehicle is liable for a charge, will almost invariably find that on entering the registration of their historic vehicle, it will state that it is subject to a charge.

The small print on the Checker facility explains why: The checker ONLY checks the emissions standard of the vehicle.

To check if a discount or exemption applies to your vehicle - and whether you need to pay the charge - go to the 'register your vehicle' process. Then scroll down to the bottom of the page and click 'start' - the link is: https://tfl.gov.uk/modes/driving/compliance-registration/before-you-start

Then, indicate the type of vehicle, and insert your registration. You will then see a message confirming it is exempt (if not, you will need to register it).

The same happens if you go to the Pay to drive in London page, as if intending to pay, it will then correctly show the vehicle as exempt. Unlike the checker facilities for other towns and cities, the ULEZ checker is only checking the emissions standard and not the VED status or age of the vehicle.

Note 1

It is the vehicle type and not its use or VED class which matters, e.g. a preserved bus is treated the same as a bus or coach carrying a full load of paying people. Buses in the 'bus' taxation class are automatically exempt from the congestion charge but those in other classes (PLG, historic, etc) need to register with TfL on an annual basis for which an admin fee is levied. Motor tricycles up to 1m wide and up to 2m long can also register at the same link. Two-wheeled motorcycles do not need to register or pay the admin charge.

A preserved taxi which is no longer registered with the licensing authorities (London or outside) counts as a car of the relevant age.

Note 2

The charges apply cumulatively – i.e. if a vehicle built in 1980s is to be driven from Marylebone to Southwark on a Friday lunchtime in May 2019 it will need to pay the congestion charge if appropriate, the ULEZ charge, and the LEZ charge if appropriate, so the totals due are as follows:

Note 3

HGVs over 12 tonnes need to comply with the 'direct vision standard'. There is an exemption for HGVs in the historic VED class but younger vehicles need to comply by fitting additional mirrors and so on. See our newsletter 5 of 2020.

Note 4

Some commercials from the mid-1970s which are exempt from the ULEZ are not exempt from the LEZ and they will still need to pay the LEZ charge even if used just in the central zone. This is because the LEZ exemption exempts all vehicles pre 1st January 1973 (regardless of VED class) and also all vehicles in the historic VED class, but only certain buses and trucks 1973 to 1980 are eligible for 'historic' VED.

Note 5

There is a concession for what are defined as “private minibuses” – this ONLY applies to minibuses that operate under a voluntary/community group permit and NOT a vehicle owned by a private preservationist.

Note 6

As of 1st March 2021 for buses and lorries, the ULEZ and LEZ charges (previously £100 and £200 respectively) were merged together into a combined £300 LEZ charge, even if the vehicle only visits Outer London. £300 is for a wholly non-compliant bus or truck (Euro III or earlier) but a Euro IV or Euro V bus or lorry pays a combined charge of £100.

The above is the Federation’s understanding of the position but drivers and vehicle owners are urged to refer to the TfL website to confirm the correct position for their vehicle. It is much simpler to resolve issues in advance rather than after the event.

Foreign historic vehicles which would, if registered in the UK qualify for the historic VED class (i.e. over 40 years old) are entitled to exemption but need to register with TfL to claim exemption.

A number of changes came into force on 1st of March 2021 (delayed due to due to coronavirus).

- LEZ emissions standards increased. Larger vehicles became subject to two different levels of charge; £100 if they meet Euro IV or V but not Euro VI and £300 if they do not meet Euro IV. This will affect a number of vehicles from the 1980s which have been successfully adapted to comply with Euro IV but which could not be further adapted for Euro VI – these vehicles will nevertheless benefit from the lower charge assuming emissions certification to Euro IV remains current.

- Direct vision scheme for trucks over 12 tonnes gross commences.

This page will be updated to reflect the above changes and any others which may occur.

Clean Air Zones

The other English Cities with Clear Air Zones are: Bath, Birmingham, Bradford, Bristol, Portsmouth, Sheffield, Newcastle and Gateshead and Oxford.

Types of clean air zones

There are 4 types of clean air zones, Class A to D.

|

CLASS |

VEHICLE TYPE |

|

A |

Buses, coaches, taxis, private hire vehicles |

|

B |

Buses, coaches, taxis, private hire vehicles, heavy goods vehicles |

|

C |

Buses, coaches, taxis, private hire vehicles, heavy goods vehicles, vans, minibuses |

|

D |

Buses, coaches, taxis, private hire vehicles, heavy goods vehicles, vans, minibuses, cars, the local authority has the option to include motorcycles |

Buses, coaches and HGVs that meet Euro VI emissions standards are exempt from any charges or restrictions.

Cars, vans and taxis that meet Euro 6 (diesel) or Euro 4 (petrol) emissions standards are exempt from any charges or restrictions.

Ultra-low emission vehicles with a significant zero-emission range are exempt from and charges or restrictions.

Birmingham

The Birmingham Clean Air Zone commenced on the 1st of June 2021 and operates 24 hours a day. This is a Class D CAZ. Private cars, tricycles, vans, buses, coaches and trucks are all affected, but two-wheeled motorcycles have not been included.

The zone covers the central area inside the Middleway (A4540) but not Middleway itself. It does however include the A38M/A4400 Queensway tunnels. A map can be found on the Birmingham City Council website

Vehicles in the historic VED class will be automatically made exempt as will overseas vehicles of equivalent age to UK-registered vehicles eligible for the historic VED class (paragraph 1(b) of annex 2 to the charging order) but overseas vehicles need to apply in advance of their visit for an exemption. There are no further exemptions for Birmingham.

Vehicles not exempt need to pay a daily charge of £50 (buses and trucks) or £8 (cars and vans). A copy of the charging order can be found here Birmingham Charging Order

Bath

The Bath Clean Air Zone commenced on 15th March 2021 and operates 24 hours a day. The zone is a class C.

The zone includes the city centre and suburbs just beyond, example Bathwick, Walcot, Royal Victoria Park, and the Wells Road hill upto (but not including) Bear Flat. The zone includes the A4, A36 and all roads within. Zone map link https://beta.bathnes.gov.uk/view-map-baths-clean-air-zone

Vans that are in UNECE category N1 are 'caught' regardless of use. In general, category N1 applies to all light vans (except car-derived vans upto a gross weight of 2 tonnes) and includes all vehicles where a lower national speed limit applies. If you are in any doubt, speak to your manufacturer and/or DVSA or DVLA.

All vehicles in the 'historic' VED class are exempt from charges and do not need to register or take any other action.

Vans, taxis and minibuses pay £9, whereas buses and trucks pay £100. The charging order is online at BathChargingOrder

Bath (only; not any of the other cities) is offering a lower rate to horseboxes and motorhomes, but not other vehicles contained within the Private HGV VED class. Such vehicles need to register in advance.

Further details on payments and local exemptions are detailed on the Bath & North East Somerset Council website. Persons paying the full rate charge do so over a payment page on gov uk whereas those eligible for a local discount such as the above paragraph use the app/website MiPermit which people may already have for parking sessions elsewhere.

Bradford

Bradford has a Class C Clean Air Zone that covers the majority of Bradford and Shipley which launched in September 2022. An interactive CAZ map is here BradfordCAZmap and the Charging Order confirming the HV exemption is here Bradford Charging Order

Bristol

The city implemented a Class D CAZ in November 2022, which will require drivers of all older, non-compliant, vehicles to pay a daily fee to enter the zone. Cars, taxis and vans that don’t meet the required emissions standard will be charged £9 per day, while trucks, buses and coaches will pay £100. The map illustrating the relevant area covered by the Zone is here BristolCAZMap

Exemptions apply for petrol vehicles that meet Euro 4 standard and diesels that meet Euro 6 standard. Electric and hydrogen vehicles are also exempt, as are motorbikes and modified or retrofitted vehicles registered with the Energy Saving Trust’s Clean Vehicle Retrofit Accreditation Scheme (CVRAS) The Charging Order which contains the relevant HV exemption is here Bristol Charging Order. There is no specific provision mentioned for overseas vehicles.

Manchester

Proposed to be a CAZ C. Currently on hold.

Portsmouth

The Portsmouth CAZ launched in November 2021. It is a Class B zone meaning that buses, coaches, taxi, private hire vehicles and heavy goods vehicles that do not meet euro 6 standards if diesel, or euro 4 standard if petrol will be charged for entry.

Non-compliant taxis and private hire vehicles will be charged £10 per day to drive through the zone, and non-compliant buses, coaches and heavy goods vehicles will pay £50 per day.

The map of the zone is here: PortsmouthCAZmap.

There are some specific vehicle exemptions, including HVs but also non commercial vintage buses. Full details are in Annex 2 of the Charging Order here Portsmouth Charging Order

Newcastle and Gateshead

Newcastle and Gateshead have introduced a Class C CAZ in January 2023 to certain parts of the city, affecting buses, coaches and lorries, plus vans and taxis. Private cars are not affected. Newcastle Charging Order An exemption for younger commercial buses is also included although drafted in slightly different terms from other similar provisions. Under the title “vintage buses”, there is a requirement for the bus details to be entered in a register. It must be a vehicle of Class M3 that at any time during a given financial year (also defined) was constructed more than 20 years and less than 40 years before 1 January in that financial year.

Non-compliant HGV’s, buses & coaches to be charged £50; taxis & vans £12.50.

However, charging for vans has been delayed until July 2023 to allow vehicle owners additional time to upgrade due to national vehicle supply issues.

Sheffield

Sheffield has implemented a Class C CAZ in February 2023, affecting a zone on the inner ring road surrounding the city centre. SheffieldCAZmap Again the normal historic vehicle exemption is in place but there is a further more limited exemption for what is termed “a non-commercial vintage bus” which includes those not younger than 20 years. Full details of the qualifying criteria are set out in Annex 2 to the Charging Order here: Sheffield Charging Order.

Oxford

Britain’s first zero emission zone (ZEZ) commenced in Oxford on 28 February 2022 and will operate from 7am - 7pm, all year round.

All petrol and diesel vehicles, including hybrids, will incur a daily charge unless subject to an exemption. Zero emission vehicles, such as electric cars, can enter the pilot area free of charge.

Launching as a pilot, the streets included in the ZEZ are: New Road, between Bonn Square and its junction with Castle Street; Bonn Square; Queen Street; Cornmarket Street; New Inn Hall Street; Shoe Lane; Market Street, from Cornmarket junction east for 40 metres; Ship Street; and St Michael’s Street.

The ZEZ pilot will allow Oxfordshire County Council and Oxford City Council to gain insights before introducing a larger ZEZ covering most of Oxford city centre next year (2023), subject to further public consultation.

All vehicles in the 'historic' VED class are exempt from charges and do not need to register or take any other action. For further details see www.oxford.gov.uk/zez

Scotland

Glasgow, Edinburgh, Dundee & Aberdeen

Made under the Low Emission Zones (Emission Standards, Exemptions and Enforcement) (Scotland) Regulations 2021, LEZs were introduced across Aberdeen, Dundee, Edinburgh and Glasgow on 31 May 2022. In Glasgow, the LEZ already applies to buses.

For other vehicle types, enforcement started on 1 June 2023 (1 June 2024 for residents within the zone). Dundee will start enforcement on 30 May 2024, Aberdeen will start enforcement on 1 June 2024 and Edinburgh will start enforcement on 1 June 2024. The emissions criteria largely following that in place for Class D zones in England.

Overall details are here: LEZScotland where further links can be found to the individual cities.

In regard to historic vehicle exemptions, Scotland has chosen a different age definition. Exemptions will apply if the vehicle was manufactured or registered under the Vehicle Excise and Registration Act 1994 for the first time at least 30 years ago and if the vehicle is no longer in production and has not been changed from its original state.

This is because non-compliant vehicles are banned from entering the zones rather than simply being subject to a charge.

General

Please note that if a car drives from central Birmingham to central London on the same day (or a bus driving from Central Bath to Central Birmingham, etc), that payments or validated exemption applications need to be made for each zone passed through.

Birmingham and Bath will use the same National Payment Systems portal although further details around whether two zones can be paid for in the same transaction are awaited. We expect that further English cities outside London are likely to join the same portal.

This page does not deal with possible discounts that may be available to residents or disabled people or to vehicles which have been adapted to meet the various emission standards.

Other countries

For information around similar zones in other countries, people may wish to consult the https://urbanaccessregulations.eu/ website as well as finding websites of cities/regions they are proposing visiting.

Historic Vehicles Visiting from Overseas

Only two cities (London and Birmingham) have made specific provisions in their Charging Orders for exempting overseas historic vehicles entering their clean air zones. As foreign registered vehicles will not generally be recognised by ANPR cameras, in both cases pre-registration is required and the vehicles must conform to the UK definition of an historic vehicle and not the FIVA one of 30 years old or more.

Indeed not only drivers of overseas registered historic vehicles will need to register; all such visitors will have to contact the city authorities to register their vehicle through the details on the CAZ webpage for that city or the generic contact site at CAZenquiry.

Although the Federation cannot guarantee that an exemption will be granted in those cities which have not made provision for overseas historic vehicle, for those which would qualify under UK rules, we suggest that contact is made as advised above and full details of the vehicle are provided. Otherwise a charge can be paid rather than a penalty charge received subsequently.

This information is believed to be correct at the time of writing, but FBHVC does not accept any liability for reliance on the contents. You are urged to double-check the position on relevant websites and so on nearer the time of your journey, and are reminded again that certain registrations are subject to your sending documents in advance.

Updated 29/8/23