Historic Vehicle Tax and MoT - The 40-year rule

Historic Vehicle Tax and MoT - the '40-year rule'

Please see our guidance below - but note that once your vehicle passes '40 years old' you need to take specific actions to make changes for both the vehicle tax (Vehicle Excise Duty - VED) and MoT, as they do not 'automatically' change.

If you do nothing, you will continue to need to pay VED and obtain a MoT certificate, irrespective of the vehicle's age.

Also, note that there is not a direct connection between the criteria for registration in the ‘historic’ tax class and hence exemption from VED, and the criteria to be considered as a Vehicle of Historic Interest (VHI) and thus qualify for MoT exemption.

In fact, they are separate situations with no commonality other than '40 years' and even that is applied differently!

Is my vehicle exempt from vehicle tax?

A vehicle which has attained 40 years age, whilst being test exempt, will need to continue to pay vehicle excise duty in the 'private light goods' or other relevant tax class until April of the following year.

You can tax your vehicle in the 'historic vehicle' tax class from 1 April if your vehicle is recorded on the V5C registration certificate (log book) as "first registered" more than 40 years ago (i.e. 1983) and is one of the qualifying vehicles listed in the DVLA leaflet INF34.

The DVLA allows a few days grace at the year end, for "first registered" dates up to and including 7 January 1984, to qualify to be tax exempt.

Currently, a vehicle "first registered" on/prior to 7 January 1984, will be classed by the DVLA as having been built in 1983, therefore it is tax exempt from 1 April 2024.

If your vehicle was 'first registered' after this date, up to 31 December 1984, you will need to wait until 1 April 2025.

Younger vehicles become eligible in the April after the year in which they become 40 years old.

For example, a vehicle "first registered" in February 1984 will be eligible to tax as a historic vehicle from 1 April 2025.

Please note: While the DVLA notes say that a vehicle is eligible to tax as a historic vehicle if it was "built or first registered more than 40 years ago", this statement can cause confusion. The two instances are NOT interchangeable. For vehicles sold new in the UK and first registered in the UK it is the 'first registration' date that is used to determine eligibility. The phrase "built more than 40 years ago" refers only to vehicles that were sold new and first registered in another country (and therefore have been imported secondhand into the UK). In this case, the front of your V5C will say 'Declared manufactured in 19xx', while the '1st registration' date on page 2 will show the date when it was registered in the UK.

DVLA leaflet INF34 gives further information, and official details are here: https://www.gov.uk/historic-vehicles

How do I apply for vehicle tax exemption?

Apply at a Post Office that deals with vehicle tax. You need to take:

- The log book (V5C) in your name

- Your vehicle tax reminder letter (V11), if you have one

- A MOT certificate that’s valid when the tax starts, or the completed declaration form if your vehicle is exempt from an MOT test using DVLA form V112 or V112G (goods)

- An insurance certificate or cover note (only in Northern Ireland.

While most Post Office branches are familiar with the process, sometimes newer staff are not. If so, simply tell the counter clerk that you wish to change the tax class to 'Historic Vehicle'. They go into their system, select 'change tax class' and the system guides them through the process. They will keep the V5C (you will be sent a replacement showing the new tax class) and they should date-stamp your V112 and attach the receipt to it and return it to you as evidence, should you get stopped at the roadside.

Certain vehicles (principally former commercial vehicles which are in obsolete tax classes) seem to present a problem for post offices. In the case of these vehicles it may be necessary to send the V5C together with forms V10 and V112/V112G/or a MoT test certificate to the DVLA.

In subsequent years a vehicle which is already in the historic VED class can be taxed either online or at a post office.

What happens next?

- The Post Office sends your log book to DVLA.

- You’ll get a confirmation from DVLA within 10 working days that the change has been made.

- DLVA will send you an updated log book within 4 weeks. You can still use your vehicle while your application is being processed.

- You will get a refund (by cheque) of any remaining full months of unexpired tax on a pro rata basis.

Is my vehicle exempt from MOT?

Vehicles generally become eligible for MOT exemption from the date they become 40 years old.

If your vehicle (car/motorcycle/bus) has not been substantially altered according to the Department for Transport Guidance it will be exempt from MOT. However, it is your responsibility to ensure it is kept fully roadworthy.

How do I exempt my vehicle from MOT? (cars/motorcycles/buses)

This is a self-declaration process to be carried out as part of annual licensing by DVLA by a keeper of a qualifying vehicle who does not wish to submit the vehicle to an MOT test.

By making this simple declaration you are confirming that your vehicle is at least 40 years old and has not been substantially changed.

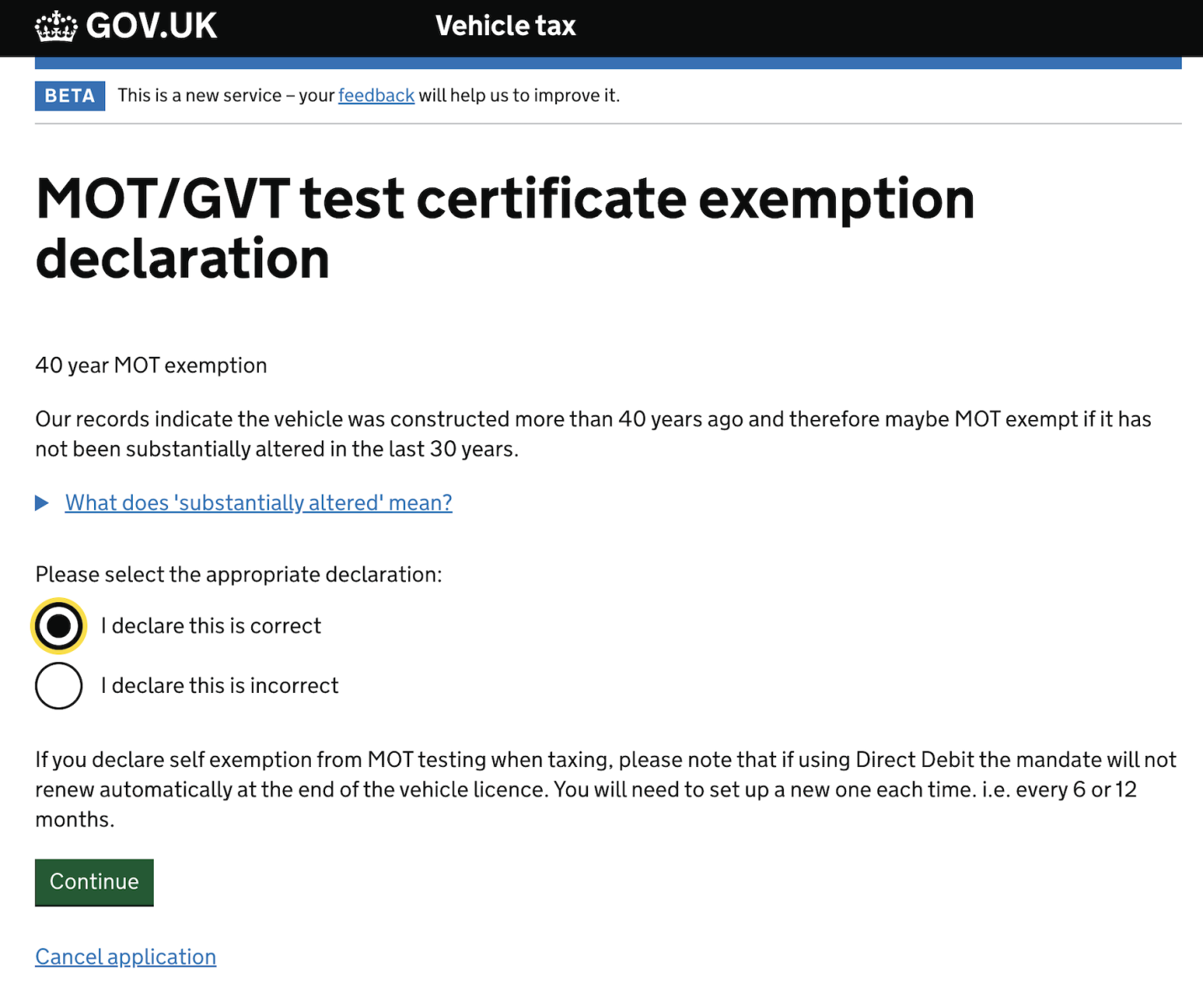

If your previous MOT has expired, you only need to declare your vehicle as MOT exempt at the point of taxation in one of the following two ways:

- Visit your Post Office with a completed V112 or V112G (for goods vehicles) form

- Or tax your vehicle online. https://www.gov.uk/vehicle-tax

When taxing your vehicle online, all post-1960s vehicles will show an extra 'tick box' for you to complete to exempt your vehicle, whereas pre-1960s vehicles will not. A sample of the screen is below:

MOT test exemption - what is a 'substantial' change?

The Department for Transport (DfT) has published a set of guidelines to assist owners in deciding which if any more recent changes to their vehicle would be considered as “substantial”.

The DfT understands that owners may feel they need to consult a specialist prior to making this declaration and have asked the Federation of British Historic Vehicle Clubs to compile and publish on its website, a list of marque specialists who have indicated their willingness to advise owners unsure of their vehicle’s status.

The list is published below (download link at the foot of this page) and it is continuously added to, as more specialists come forward.

Before approaching a marque specialist you should study the DfT Guidelines carefully and make your own judgement concerning your vehicle, if you can.

An expert or an organisation nominating an expert is entitled to reimbursement of any costs incurred in reaching or providing the opinion and may make a reasonable charge for the service provided, which may be different depending upon whether the keeper making the request is or is not a member.

It is your responsibility to accurately describe your vehicle as no inspection will be made. Their advice is provided solely in relation to the declaration you will make regarding a vehicle of historical interest (VHI).

If there is not a specialist listed here for your type of vehicle you may contact the FBHVC Secretary (secretary@fbhvc.co.uk) who will advise you.

Note

A vehicle which has just attained 40 years age, whilst being test exempt, will need to continue to pay vehicle excise duty in the 'private light goods' or other relevant tax class until April of the following year. This vehicle may have a SORN declared towards the end of March (which would trigger a refund) in order to then be relicensed in early April in the historic class at a post office as outlined above.

Lorries are only test exempt if they are pre-1960, a date restriction which also applies to buses used commercially, again in both cases subject to the 'not substantially changed' criteria.

Finally, please note that some vehicles are exempt from both tax and test, certain vehicles are exempt from test, others are exempt from tax, and some vehicles are not exempt from either.

Regardless, any vehicle that travels on the public highway must be roadworthy at all times.

Downloads

| +VHI List v11 30.06.2023.pdf |